Actually, FTX is already becoming the daily topic of discussion of national focus in The Bahamas – and we have at least three solid years to go before the next general election. It looks like a rough ride ahead on the FTX wave with ‘Brave’ – in my humble estimation. Like the song goes: Oh Sam – oh Sam, by damn – by damn.

By Dennis Dames

Nassau, NP, The Bahamas

Nassau, NP, The Bahamas

It’s the worst case of betrayal of public trust that I have seen in my lifetime. Many of the clients concerned – are expressing their frank and honest emotions in social media circuits as the FTX saga plays out in bankruptcy court; and their sentiments are far from nice and pleasant.

All of this is happening while the former loose cannon CEO of FTX continues to add fuel to the fire in the press and on social media platforms. He simply cannot keep his friggin trap shut!

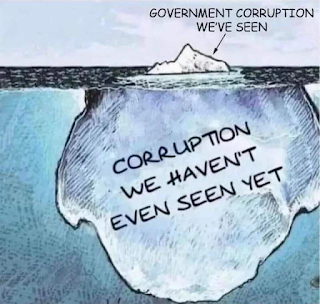

There are already reported cases of suicides and assassinations relating to the demise of FTX in countries around the world, and the situation is looking grimmer by the minute. The complete fallout from FTX’s failure is unknown, but one thing if for sure, and that is many politicians – especially in the USA have a lot of questions to answer for the general voting public in regards to FTX failed crypto exchange.

It will have a great influence on the next Presidential election in the United States and the next round of midterm congressional elections – in my opinion. Trump is going to have the time of his life – I can imagine. Wow wow we waa!

Politicians in The Bahamas will also have a lot of voters questions to answer, and FTX could be the main subject of concern moving in to the next general election season in The Bahamas. This is totally bad and unwanted news for the ‘New day’ administration – no doubt.

Actually, FTX is already becoming the daily topic of discussion of national focus in The Bahamas – and we have at least three solid years to go before the next general election. It looks like a rough ride ahead on the FTX wave with ‘Brave’ – in my humble estimation. Like the song goes: Oh Sam – oh Sam, by damn – by damn.

FTX will adversely affect a good number of governments in our universe – as more and more horrific details of its internal operations are publicly revealed. It’s a budding international scandal of monumental proportions. Let’s face it, as it’s not going anywhere soon.