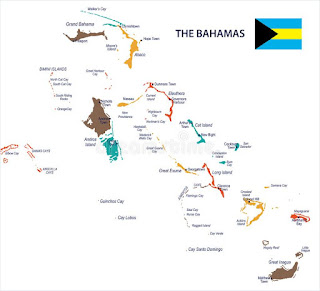

The Bahamas - A Nation in Crisis: A Roadmap for Economic Recovery, Debt Reduction, and National Development in The Bahamas

Nassau, The Bahamas

The Bahamas, once a leading economic force in the Caribbean, is now at a critical juncture. The national debt has ballooned, competitiveness has waned, and global competitors, like Bermuda, have overtaken The Bahamas in key sectors such as captive insurance and financial services. This situation poses serious risks for the nation's future stability, especially considering the lack of financial buffers to withstand natural or economic disasters.

The time for comprehensive reform is now. The Bahamas must act decisively to address issues in immigration, inland revenue, financial regulation, and urban development, while leveraging examples from countries like Singapore, India, and Jamaica that have successfully implemented similar reforms. Through bold and innovative measures, The Bahamas can reduce its debt, foster economic growth, and build a resilient future for all Bahamians.

1. Commendation for Inland Revenue and Insurance Sectors

The Inland Revenue Department and insurance sectors are integral to the financial stability of The Bahamas. Their recent progress in collecting taxes and generating revenue has been commendable, but more must be done to ensure efficiency and sustainability. The reliance on contract workers, many of whom lack adequate training, has been a challenge. By transitioning these workers to permanent roles and providing formal training that includes a minimum C grade in Math and English, the government can create a stable and efficient workforce capable of driving tax collection efforts (Bahamas Ministry of Education, 2021).

This initiative must be paired with an increase in the minimum wage to ensure that workers are fairly compensated, thereby boosting morale and increasing consumer spending. Such measures will help alleviate economic challenges while promoting greater stability in the workforce.

2. Addressing National Debt and Economic Competitiveness

The Bahamas faces a crippling national debt, which as of 2020, had exceeded 103% of GDP (Central Bank of The Bahamas, 2021). If not addressed, this debt will hinder the country’s ability to invest in critical sectors like infrastructure, education, and healthcare. Countries like Norway and the UAE have successfully mitigated such risks by creating sovereign wealth funds, which serve as financial buffers during times of crisis. Establishing a similar fund in The Bahamas could provide a safety net in the event of natural disasters or economic downturns.

Additionally, The Bahamas must reform its financial services regulations to remain competitive on the global stage. Bermuda’s rise as a global leader in captive insurance is a direct result of its business-friendly regulatory environment. The Bermuda Monetary Authority has created a balanced regulatory framework that encourages innovation while maintaining compliance, thus attracting international businesses (Bermuda Monetary Authority, 2020). The Bahamas must take similar steps to regain its competitive edge.

3. Leveraging Customs Instruments and Targeted Taxation for Revenue

To boost national revenue, The Bahamas can implement a sugar tax or similar levies on unhealthy products such as sugary drinks and fast food. This model has been successful in New York City, where taxing sugary beverages and junk food has raised revenue and improved public health outcomes (New York City Department of Health, 2019). Such taxes in The Bahamas would target large multinational companies, such as McDonald’s, and provide funds that can be reinvested into critical areas like healthcare, education, and sports development.

Revenue from these taxes should also be allocated toward developing youth programs, supporting social services, and funding national initiatives that promote health and well-being across the country.

4. Reforming Immigration Policies for Nation Building and Economic Development

The Bahamas’ current immigration policies are too restrictive and limit the country’s ability to attract skilled professionals, entrepreneurs, and digital nomads. Countries like Canada and Singapore have implemented practical immigration policies that bring in skilled workers who contribute to their economies (Canadian Immigration and Citizenship, 2020). The Bahamas should follow this model, easing immigration restrictions to attract multinational companies (MNCs) and skilled workers who can drive economic growth.

Additionally, undocumented immigrants who are currently part of a parallel economy should be brought into the formal system. Legalizing their status would allow them to contribute to tax revenues and reduce the strain on public services, while also enhancing national security. Immigrants are a crucial part of nation-building, and The Bahamas must capitalize on their potential to stimulate economic growth.

5. Implementing a Regulated National Lottery for Systematic Revenue Generation

A regulated national lottery could provide a valuable source of revenue for The Bahamas, funding essential sectors like sports, education, and social services. Countries such as Barbados and the United Kingdom have used national lotteries to generate significant revenue for national development initiatives (Barbados National Lottery Report, 2020). Implementing a similar system in The Bahamas would reduce the national debt and provide consistent funding for key public services.

By regulating the lottery, The Bahamas can ensure that funds are allocated systematically, with a focus on youth development, national sports programs, and education. This will not only alleviate debt but also foster national pride and engagement.

6. Revamping Banking Regulations for Entrepreneurs and Business Development

The Bahamas' banking regulations are currently too restrictive, making it difficult for entrepreneurs and small businesses to access capital. To support entrepreneurship and stimulate economic growth, the government must implement banking legislation that simplifies access to loans and financing for startups and small businesses.

Countries like India have successfully implemented banking reforms that support small and medium-sized enterprises (SMEs), which are vital to their economy. By adopting similar reforms, The Bahamas can foster a business-friendly environment that encourages innovation and investment (Government of India, 2020). Additionally, exchange control policies should be modernized to attract foreign direct investment (FDI), as investors are more likely to bring capital into a country where financial regulations are transparent and flexible (IMF, 2021).

7. Revitalizing Downtown Nassau and Developing Special Economic Zones (SEZs)

Downtown Nassau is in dire need of revitalization. The area’s colonial architecture is deteriorating, and the lack of modern infrastructure has made it difficult to attract multinational corporations (MNCs) and tourists. By redeveloping Bay Street into a modern economic hub, The Bahamas can attract global businesses and create jobs for local residents. This redevelopment should focus on creating a dynamic space for local businesses and international companies, driving economic activity and tourism.

Additionally, The Bahamas should establish Special Economic Zones (SEZs), similar to those in Dubai and Singapore, offering tax incentives and regulatory relief to attract foreign companies and investors. SEZs can serve as innovation hubs for technology, finance, and entrepreneurship, positioning The Bahamas as a competitive player in the global economy (Government of Singapore, 2020).

8. Strengthening the National Accreditation and Equivalency Council of The Bahamas (NACoB)

The National Accreditation and Equivalency Council of The Bahamas (NACoB) is responsible for ensuring that the country's educational institutions meet international standards. However, NACoB requires reform to ensure that it is staffed by individuals with the necessary academic and professional qualifications to maintain ISO quality standards.

Countries like Jamaica have successfully implemented educational reforms by appointing qualified professionals to lead their accreditation bodies, ensuring that institutions are held to high standards (Government of Jamaica, 2019). The Bahamas should adopt a similar approach to strengthen NACoB and ensure that the country's educational institutions are globally competitive.

9. Establishing Planning Commissions for Sustainable Development

The Bahamas must establish Planning Commissions modeled after those in India and Singapore to ensure long-term sustainability and development. India’s NITI Aayog, for example, serves as a central policy think tank that drives economic growth and development (Government of India, 2020). Similarly, Singapore’s Economic Development Board plays a crucial role in shaping the country’s economic policies, ensuring that Singapore remains competitive globally (Government of Singapore, 2020).

The Bahamas should establish independent planning commissions tasked with setting national growth targets, managing resource allocation, and evaluating the performance of government departments. These commissions must be free from political interference and staffed by professionals who understand global best practices in policy development.

10. Conclusion: A Call for Introspection, Reform, and Nation Building

The Bahamas stands at a pivotal moment in its history. Faced with mounting national debt, declining competitiveness, and an outdated regulatory framework, the country must undertake comprehensive reforms to secure its future. The examples set by Singapore, India, Bermuda, and Jamaica show that transformation is possible with visionary leadership, practical policies, and a commitment to nation-building.

By reforming immigration policies, modernizing banking regulations, strengthening inland revenue, and implementing a regulated national lottery, The Bahamas can create a more competitive business environment, reduce national debt, and foster long-term economic growth. Moreover, the revitalization of downtown Nassau and the establishment of Special Economic Zones (SEZs) will attract international businesses and generate jobs, while reforms to NACoB will ensure that the country’s educational institutions meet global standards.

This is not just about economic reform; it is about building a better future for our children, grandchildren, and generations to come. We must look inward, evaluate our strengths and weaknesses, and implement policies that ensure sustainable development and prosperity for all Bahamians. Through visionary leadership, investment in human capital, and a commitment to global best practices, The Bahamas can emerge stronger, more resilient, and ready to take on the challenges of the 21st century.

The journey will not be easy, but it is necessary if we are to leave behind a Bahamas that is prosperous, peaceful, and prepared for the future. We owe it to future generations to act now—together, we can build a nation that not only thrives economically but also serves as a beacon of hope and progress for the world.

References

Barbados National Lottery. (2020). Annual Report. Retrieved from https://www.barbadoslottery.com/

Bermuda Monetary Authority. (2020). Annual Report. Retrieved from https://www.bma.bm/

Canadian Immigration and Citizenship. (2020). Annual Report. Retrieved from https://www.canada.ca/en/immigration-refugees-citizenship/corporate/publications-manuals/annual-report.html

Central Bank of The Bahamas. (2021). Annual Economic Review 2020. Retrieved from https://www.centralbankbahamas.com/research-publications

Government of India. (2020). About NITI Aayog. Retrieved from https://niti.gov.in/

Government of Jamaica. (2019). Education System Transformation Programme. Retrieved from https://www.moey.gov.jm/

Government of Singapore. (2020). Singapore Economic Development Board. Retrieved from https://www.edb.gov.sg/

IMF. (2021). Bahamas Staff Report. Retrieved from https://www.imf.org/external/pubs/ft/scr/2021/cr21248.pdf

New York City Department of Health. (2019). Sugary Drinks Taxation and Health. Retrieved from https://www1.nyc.gov/